south dakota property taxes by county

Hamlin County Treasurer PO Box 267. Please allow 7-10 business days to process if paying online.

Dakota County Mn Property Tax Calculator Smartasset

Spink County Redfield South Dakota.

. Lincoln County has the highest property tax rate in the state at 136. The Treasurer is not only responsible for collecting property taxes for the county but the city and school districts as well. South Dakota has 66 counties with median property taxes ranging from a high of 247000 in Lincoln County to a low of 51000 in Mellette County.

Enter only your house number. Second half property taxes are due by October 31. You can look up your recent.

If the county is at 100 of full and true value then the equalization factor the number to get to 85 of taxable value would. Motor vehicle fees and wheel taxes are also collected. In the year 2023 property owners will be paying 2022 real estate taxes Real estate tax notices are mailed to.

You can look up current Property Tax Statements online. The median property tax in South Dakota is 162000 per year for a home worth the median value of 12620000. Real estate taxes are paid one year in arrears.

Hayti South Dakota 57241-0267. Look up statements online. South Dakota property taxes Local News South Dakota News.

The median property tax in Minnehaha County South Dakota is 2062 per year for a home worth the median value of 144900. ViewPay Property Taxes Online. Please click HERE to go to payview your property taxes.

If you are a senior citizen or disabled citizen property tax relief applications are available through. Go to the Property Information Search. State Summary Tax Assessors.

Please bring your tax notices with you. Tax payments must be made for the exact amount only. Tax amount varies by county.

Spink County Government Redfield SD 57469 Home. The median property tax in South Dakota is 162000 per year based on a median home value of 12620000 and a median effective property tax rate of 128. 128 of home value.

The assessed value is based on the market value or what the value of the property is actually worth. To find detailed property tax statistics for any county in South Dakota click the countys name in the data table above. In-depth content for South Dakota County Auditors on calculating growth percentage CPI Relief Programs TIF and other property tax essentials.

Redemption from Tax Sales. This is determined by comparing the property to be assessed with the selling price of. Then the property is equalized to 85 for property tax purposes.

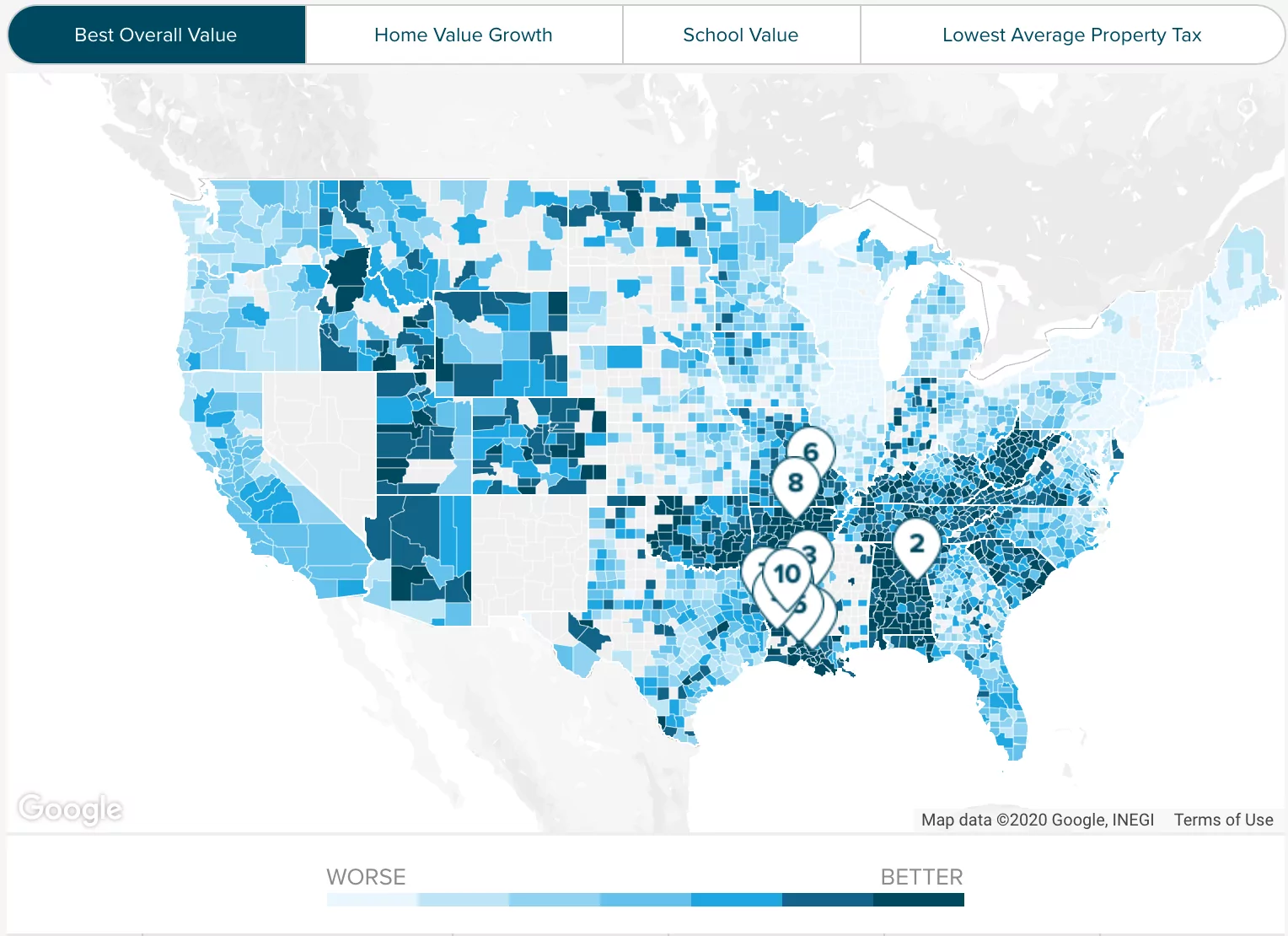

This data is based on a 5-year study of median property tax. Governor Noem speaks to Rapid City residents before Election Day. The effective average property tax rate in South Dakota is 122 higher than the national average of 107.

Saturday October 1 2022. SDCL 10-24 In South Dakota property owners have a period of time during which they can repurchase redeem their property by paying the amount owed. The Minnehaha County Treasurers Office seeks to provide taxpayers with the best possible services to meet the continued and growing needs of Minnehaha County.

Click here for any questions about tax. Minnehaha County collects on average 142 of a propertys.

Property Tax South Dakota Department Of Revenue

County Treasurers South Dakota Department Of Revenue

Equalization Lincoln County Sd

Are There Any States With No Property Tax In 2022 Free Investor Guide

The Tax Rate On A 2 Million Home In Each U S State Mansion Global

Minnesota Property Taxes Not The Worst But Could Be Better American Experiment

Pennington County Treasurer S Office Archives Knbn Newscenter1

Taxes Spearfish Economic Development

Minnehaha County South Dakota Official Website Minnehaha County Pay Search Property Taxes

Tax Estimates Jamestown Sun News Weather Sports From Jamestown North Dakota

Are There Any States With No Property Tax In 2022 Free Investor Guide

South Dakota Property Tax Calculator Smartasset

South Dakota Property Tax Appeals Important Dates Savage Browning

Property Taxes By State In 2022 A Complete Rundown